Written by Oumou M. Camara, Ph. D, Regional Director and Stella Obanyi-Brobbey, Soil Fertility Expert, IFDC North and West Africa, Ghana / Posted Courtesy of Fertilizer Focus

West Africa’s ability to reach sustained economic transformation, poverty reduction and secure the future of food and nutrition hinges on transforming its agriculture sector. The sector currently contributes 35% to the regional domestic product, employs over 50% of the labor force and is necessary for broad-based economic growth. With an improved policy environment, higher global agricultural prices, and stronger demand growth, the conditions for sustained intensification of agriculture have never been better. Yet, the region’s ability to tap into its huge production potential has been limited by the loss of millions of soil nutrients over decades, leading to significant land degradation and locking the region into a low productivity trap.

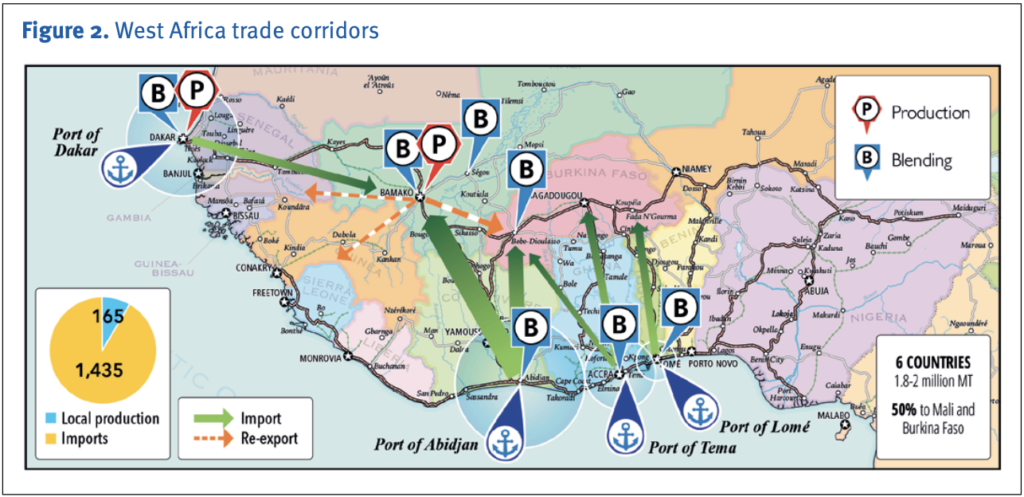

Today, the region presents a significant growth potential (50% increase) for fertilizers that are adapted to the cropping and agroecological particularities of the production ecosystems. West Africa only consumes 2% of the world’s fertilizer – between 1.5-1.7 million metric tons (mt) annually. Fertilizer use in the region remains the lowest globally, with an average application rate of just 20 kg per hectare. Of this, 90% is imported on the international fertilizer market (i.e., from Morocco, Russia, Ukraine, European Union, USA, and China). Three countries (Burkina Faso, Mali, and Niger) in the ECOWAS trading block are landlocked and rely on other ports for imports. The large trade in fertilizer underscores the critical importance of fertilizer logistics in increasing the demand of adapted fertilizer, reversing nutrient mining, and increasing agricultural yields and incomes.

Coordination and Management

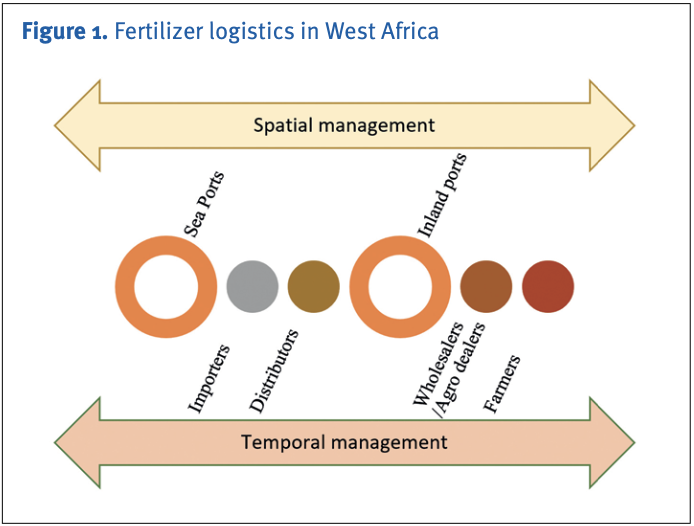

Fertilizer logistics in West Africa entail its effective spatial and temporal management to deliver quality fertilizer products in sufficient quantity at the right time, in adequate packaging, and at an affordable price to farmers. Key logistical functions include timely and effective coordination and management of procurement (imports) and inland distribution.

The flow of fertilizers changes significantly each year depending on a number of factors.

Fertilizer imports transit mainly through the ports of Lomé, Tema, Abidjan, Lagos, Port Harcourt, and Dakar, while Takoradi and San Pedro are increasingly playing a bigger role. Abidjan (Côte d’Ivoire) handles the largest fertilizer volume with an average of 525,000 mt of fertilizers imported over the last five years (2015-2019), representing 32% of the region’s total imports, followed by Tema (Ghana) with about 450,000 mt/year and 27.3% of total imports, Dakar (Senegal) with an estimated 325,000 mt/year and Lomé (Togo) with an estimated 175,000 mt/year. The remaining 25,000 mt/year are imported via San Pedro and Takoradi. Other import ports are Cotonou, Benin, and Lagos, Nigeria.

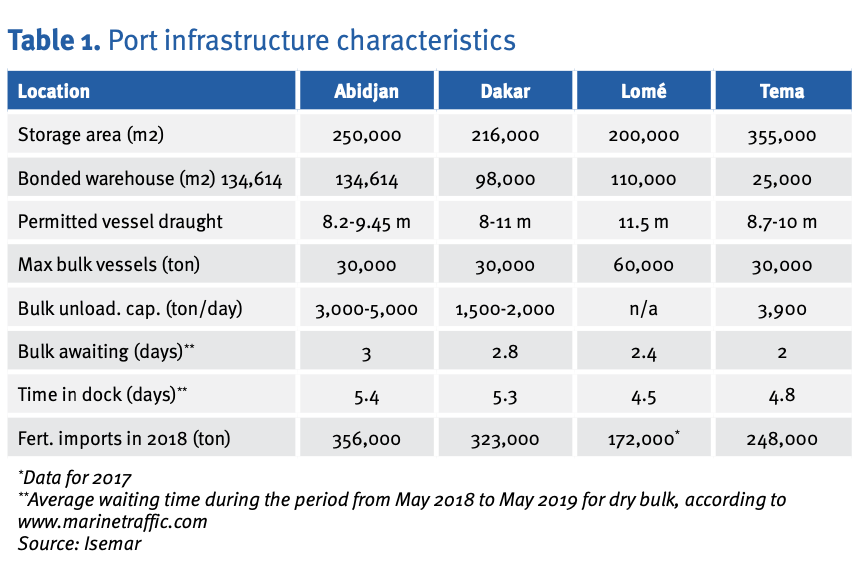

Fertilizers move from manufacturers/traders to importers/blenders, distributors, wholesalers, retailers, and finally to farmers. Fertilizer flows change significantly each year depending on opportunities, tenders, and the importing companies’ market shares. From the ports, fertilizer is delivered to different categories of consumers in the hinterland. Movement of fertilizer from the ports of Abidjan are geared toward Mali and Burkina Faso, Dakar supplies Mali and Niger, and Tema and Lomé supply Burkina Faso. The bulk of the fertilizer for bagging is transported by rail and road networks. The quality of the port infrastructure is determined by several criteria, such as storage area, bonded warehousing, permitted vessel draft, maximum bulk vessels allowed, and bulk unloading. Table 1 shows the competitiveness of the four ports of Abidjan, Tema, Lomé, and Dakar.

The port of Tema has the largest storage area and a high daily bulk unload capacity but is limited in the availability of warehouses. Tema is considered the most competitive and has potential for improving efficiency and reducing port costs.

Transport Opportunities

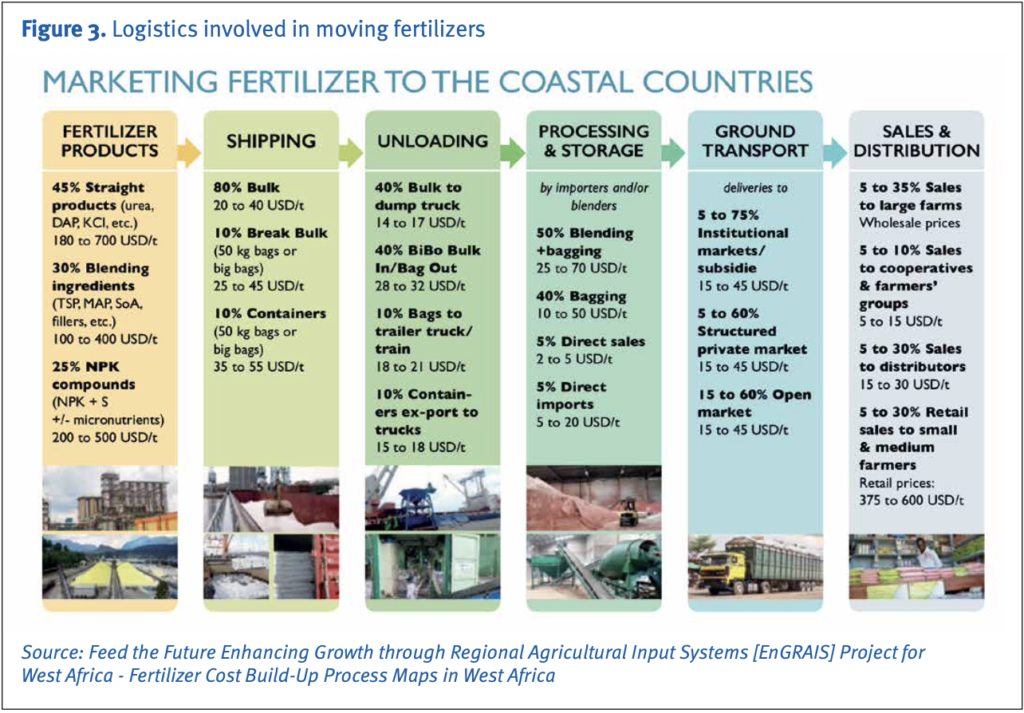

Fertilizer transportation from the ports to warehouses and to the farm gate is primarily carried out by rail or roads. The choice of transportation method differs depending on whether the fertilizer was bagged or not, the geographical location between the port and the destination, the quality of the roads, trucking costs, and the opportunity for backhauling of export goods. The major constraint in this case is the alignment of the harvest season with the fertilizer import season. This can be addressed with good planning and creation of platforms where agricultural commodity exporters, fertilizer importers, and transporters can interact.

Temporal management is the second critical element of fertilizer logistics.

Temporal management of fertilizers is the second critical element of fertilizer logistics. With most farmers relying on the rainy season for cropping, fertilizers must reach farmers before the beginning of the rainy season; therefore, its movement, as depicted in Figure 3, must be carefully managed to reach farmers at the right time. To increase efficiency of fertilizer movement, collaborative logistics are necessary in synchronizing products for export with the incoming fertilizer, thus eliminating backhauling costs. Collaboration between the agricultural commodity exporters and fertilizer importers would create a win-win situation.

Improving Spatial and Temporal Management

Effectively managing the spatial and temporal management of fertilizer in West Africa entails logistical improvements that will be reflected in reduced transaction costs. Fertilizer costs can be categorized into transport costs, port costs, duties and taxes, storage costs, financial costs, and operational costs. For example, the average cost of urea ranges from USD 319 in Senegal to USD 475 in Niger. In 2020, fertilizer was delivered at between USD 330-360/mt in most countries in West Africa and domestic costs add between 50-85% to the current FOB price. The average FOB price represents nearly 60% of the final cost of urea delivered to wholesale warehouses in the fertilizer consumption areas. Import logistics is a key driver in determining fertilizer prices in rural areas in West Africa.

Logistical costs (sea transport, land transport, and handling) account for about 20% of the costs and operational costs (gross margins, salaries, taxes, incidentals, and onsite handling) average about 12%.

Financial costs, such as duties and taxes, are estimated at around 7% of the total cost, with significant variations from one country to another and from month to month. The sea freight (Baltic/Black sea) differences between West African ports are negligible, although the port of Dakar enjoys a slight advantage of +/- USD 2/mt due to its geographical position.

An important factor is the economies of scale, with larger ships being cheaper. Packaging is also a key factor in costs with importation of packaged fertilizer being more expensive by USD 2.00-5.00. In terms of port fees, Tema is the most competitive, and Abidjan is the least competitive.

Land transport in West Africa bears the highest cost in the fertilizer supply chain at an average of USD 0.07/mt/km, compared to Europe which averages USD 0.03/mt/km. This high cost is attributed to the competitiveness of the corridor and the distance between the port and the production area.

Improving Port Efficiencies

Import documentation often delays the importation of fertilizer. There are six levels that importers go through before the fertilizer can reach the consumers:

- Preparation for contract signing

- Pre-shipment

- Maritime transport

- Unloading

- Customs clearance or transit

- Ex-port and delivery

These take up to four months to complete, and the longer it takes, the higher the cost of fertilizer for consumers. Improving port efficiencies, such as with a paperless system, would reduce the transaction time and costs.

Port congestion increases the time it takes to offload the fertilizer and this contributes to higher fertilizer costs. Lack of warehousing and bagging equipment increases the length of time fertilizer takes at the port, which also adds to costs.

Labor availability for offloading and bagging fertilizer at the port is critical for the speed of port operations. With governments introducing curfews to control the spread of the COVID-19 virus, port operations were significantly delayed, leading to higher costs.

Poor road infrastructure is the greatest contributor to transportation costs. Trucks are faced with numerous challenges as they move on poor roads, which afflict the entire region, mainly because they must move slowly. In addition, theft, terrorism, criminal activities, diseases, and natural disasters contribute to delayed deliveries and increasing operational costs.

Strategic Investments

Reducing transaction costs along the fertilizer supply chain will necessitate sizeable improvements in planning to address the spatial and temporal constraints.

Reducing transaction costs along the fertilizer supply chain will necessitate sizeable improvements in planning physical systems, information systems, and managerial systems to effectively address the spatial and temporal constraints in West Africa. Strategic investments in three areas are key:

1. Information systems: Improved transparency along the trade corridors is essential to de-risk the supply chain and optimize the flow of market information to enable market actors to respond to price incentives. Platforms such as the West African Fertilizer Association and AfricaFertilizer.org are in place for facilitation.

2. Collaborative management: Increased collaboration between key stakeholders to ensure that fertilizer flows smoothly from ports to farmers is critical to reducing transaction costs. More specifically, collaboration between grain exporters and fertilizer importers is essential to reduce backhauling costs and farm-gate prices of fertilizer.

3. Quantity and quality of logistics infrastructure and equipment: Improved quality and quantity of logistics infrastructure can lead to significant efficiency gains, especially infrastructures at the port as well as transportation infrastructure and equipment.

Read more from Argus Media’s Fertilizer Focus.